A savings calculator is an indispensable online tool for anyone serious about managing their financial future. It moves financial goal setting beyond mere hope and transforms it into precise, quantifiable action. By simulating various scenarios, the calculator helps visualize the potential growth and the time required to reach specific monetary targets within your bank savings account. This simple tool helps users understand the true impact of their saving habits and the prevailing savings account interest rate.

Quantifying Goals and Growth Potential

The core utility of the savings calculator is its ability to project the future value of savings and to map out the required steps needed to achieve a specific financial target, providing clarity and measurable milestones.

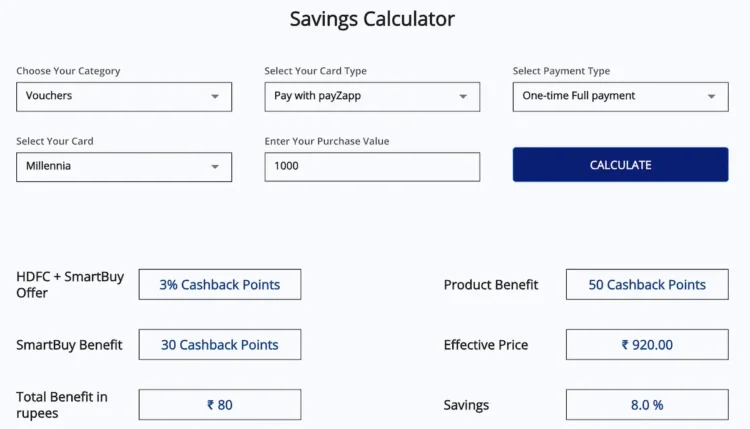

- Goal-Based Planning and Reverse Engineering: The calculator enables highly targeted saving. You can input a desired goal amount (e.g., a figure for a large purchase or a future expense) and the required deadline. Based on the assumed savings account interest rate and compounding frequency, the online tool can reverse-engineer the required inputs, calculating the exact minimum monthly deposit necessary to hit that target on time. This provides a direct, actionable requirement for integration into your personal budget.

- Illustrating Compounding and Consistency: The tool powerfully demonstrates the acceleration of growth due to compounding. By comparing a scenario with consistent regular contributions versus one without, users gain a clear, visual understanding of how small monthly deposits grow big over time. This clear visualization reinforces the importance of consistent saving habits in a savings account.

- Scenario and Sensitivity Analysis: The calculator provides immediate feedback when variables are adjusted. For instance, a user can quickly input a slightly higher savings account interest rate (perhaps from a prospective best savings account option) or increase the monthly contribution amount to see the immediate impact on the final total. This allows for informed “what-if” analysis, guiding decisions on whether to seek a better-rate product or adjust the monthly budget for the bank savings account.

Fostering Financial Discipline

Beyond providing numerical projections, using the savings calculator helps to establish and maintain better financial behaviors, making the management of your bank savings account more proactive and disciplined.

| Planning Benefit | How the Calculator Helps |

|---|---|

| Motivation and Focus | Provides a concrete, quantifiable financial target and tracks progress, making long-term goals feel more immediate and attainable. |

| Realistic Budgeting | Determines the exact monthly contribution required to hit a goal, which can then be formally incorporated into a personal or household budget. |

| Product Comparison | By allowing the user to input various potential savings account interest rates, it guides the search for the product with the highest return, helping locate the best savings account for their funds. |

Conclusion

The savings calculator is far more than a simple projection tool; it is a vital planning instrument that provides essential and actionable insights. By giving individuals the power to quantify their financial targets and clearly visualize how small monthly deposits grow big over time, it fosters motivation and ensures that savings efforts are focused and efficient. This mastery of the online tool leads to smarter allocation of resources and a clear, data-driven path toward maximizing the future value of savings in your bank savings account.

Also read: Why Do People Use Forbrukslånkalkulator or Consumer Loan Calculator?