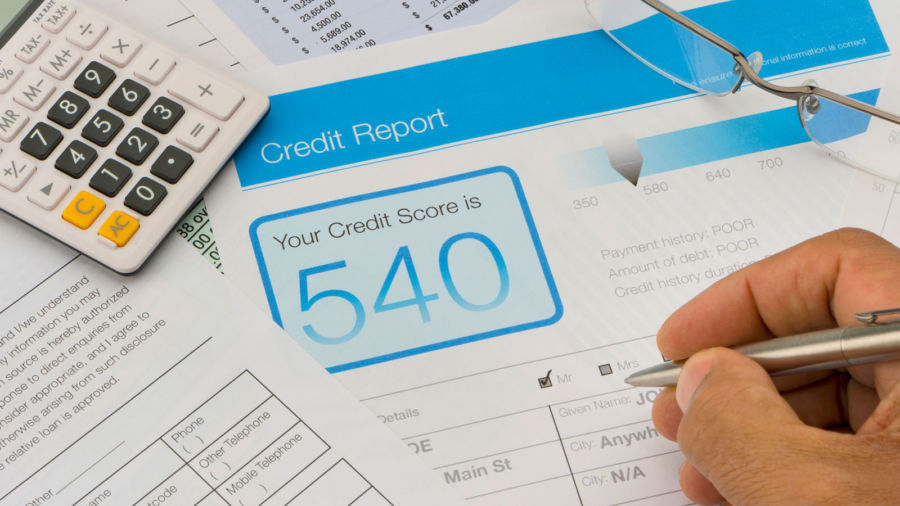

Being in bad credit mortgage Canada can create tough situations for investors. As constant cash flow is necessary to ensure paying loans or buying properties. There is a chance that now you have been missing out on bills or have other debts. Your credit file shows everything and you need a good credit history for private or banking loans.

Bad credit mortgage Canada black marks

There are many black marks that can be in your credit file. And, because of that, you cannot qualify for home loans. Let’s discuss some of them below:

Arrears or missed payments

It is possible that you have missed payments of your house loan in the past. The more times you do that, the more is the problem. Every lender whether private or bank, checks your credit mortgage history to make sure you qualify. Banks are highly strict and they do not refinance your loan if you missed one payment in a year.

Credit history

Your bad credit mortgage Canada history will tell a lot about you before someone checks out your portfolio. There is a great chance that you have been good on your loans before but things can happen.

Bills and tax history

Your bills and tax history matters a lot and the organizations can check them as it goes in your bad credit history. Your files show visible results of documents that they require from you.

Financial troubles

Sometimes it won’t be you but the company you work for is in financial trouble. There could be late payments that might be affecting your history.

Too many investments

Too many investments seems like a great idea to increase your portfolio. But you must maintain your budget for each. You might not be able to commit to every one of them.

How to approve your loan with bad credit mortgage Canada

Well, the honest answer here is that most of the big financial companies and banks including top lenders will back out. But, there are some special lenders that are flexible with bad credit policies. They will go through your loan application and portfolio to discuss everything with you in detail. The best part is that they listen to your side as well and know more about your financial position. They try to provide you with the best solutions or alternatives that can help you out.

Specialist lenders can help you in approving loans for bad credit so you can meet your deadlines.

Why people get into bad credit mortgage Canada

Well, first thing is that if you have a bad credit history then it does not mean you are a bad person. Neither financially broke. Maybe some of the times are hard for everyone. There can be incidents like divorce, accidents, loss of job and some other that you have gone through. Of course, they cast affects on your credit history and cause it to be bad.

People living in suburbs can get bad credit history due to the financial stress they go through. Interest rates are rising with great power and it becomes hard to meet both ends.

Therefore, you need to trust professionals that can get you out of bad credit mortgage Canada.

Also read: How to Improve Your Credit Score