Before you start a business or meet specific needs, you need to find the money. If personal savings are not enough, you can borrow from acquaintances. But it is unlikely that your loved ones can bring you large sums of money. That’s why many people choose credit. A loan is a relationship between two parties when one gives money to the other under the condition that the other will return the loan with interest. It is a kind of obligation. There are many types of credit now.

This article will tell you what you need to know about a loan secured by real estate. What does it mean, who is eligible, and is it possible to be left without property? You can also use quick faxless payday loans if you need the money fast.

What is a Home Equity Loan?

To make it short and clear – Home equity loan is a loan secured by real estate is a transaction where the borrower takes money from the bank and promises to return it within a specific time. If the borrower fails to fulfill his obligations, the lender has the right to take the pledged property from him.

To make it as straightforward as possible, let’s look at a specific example:

Jack needed money to start a business. A consumer loan for such a large amount was not available to him. He had to work it out and pledge his apartment as collateral. The bank agreed and gave him the money.

And then there are two outcomes

Business went south, and Jack was able to pay back the loan. His apartment stayed with him. In that case, the only thing he lost was the money to pay the interest on the loan.

The business fails to run. The borrower is unable to pay back the money. Then the bank will take Jack’s apartment. And he will sell it for the exact amount of money that he lent. If the house is worth more, the owner will likely get the rest of the capital. But there are different situations. The owner might get nothing.

What Kinds of Credit is Available Against a Mortgage?

But in fact, you can pledge other real estates. In our example, we have considered an apartment with a mortgage. The main thing is that it is worth enough to take the loan. The borrower can only take the amount that does not exceed 75% of the value of his property. It is unlikely that he gets more.

Loan Secured by the Apartment

If you need a large sum, the house is often mortgaged (it usually costs more). It is even possible to put up the apartment, which does not belong to the borrower, but if the owner’s consent.

Jack took a mortgage on his apartment. He is registered in it but is not listed as the owner. His relatives can go along and give consent. But they are not obliged to do so, so it is better, of course, to dispose of their property.

If the borrower could not repay the money, many banks put the house up for auction and take away what they are entitled to. They usually don’t care about the owner’s interests. So if you understand that you might not be able to pay the money back, it is better not to mortgage the apartment.

You do not need to get out of the apartment or register it with the bank. You will still be the legal owner of the apartment. The right is transferred only in case of default.

Loan Secured by a Car: How Does It Work?

You can pledge your car, too. In the event of something, to lose the means of transport is less offensive than the only housing.

Professionals will evaluate the vehicle, and only after that can you get a loan. If the car is in deplorable condition, then you will not be given a loan for a large sum. Cars are usually mortgaged for relatively little money.

For example, banks will readily give a mortgage of a house, a piece of land, an apartment, or a home in the country. Some lending organizations even consider mortgaging expensive machinery.

When You Need to Take Out a Credit

Different things happen — you need money for medical treatment, a wedding, a trip, your own business, etc. Banks, of course, may ask you why you need the money. But by and large, they do not care — you give the deposit, which is very important for banks.

And often, people get a lot of small loans and then have no idea how to repay them. Getting out of this pit is difficult but possible. It is pretty realistic to take out a large loan secured by real estate to pay off small loans.

Home equity loans are usually longer-term and lower interest rates. In addition, banks have the peace of mind to guarantee that they will get their money back. Obtaining a loan without collateral and guarantors is much more difficult.

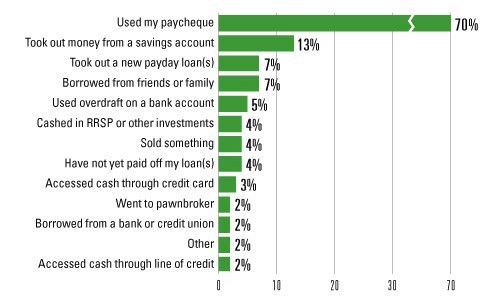

According to statistics, people typically paid back the amount owed for their payday loan using their paycheck.

Loan Secured By Real Estate: What Documents Are Needed

Most often, you only need a passport. You can get approval even through the computer, without visiting the bank. Fill out an application in 5 minutes, enter your data, and then experts will contact you. Sometimes banks require a certificate of income, check the requirements of each credit institution.

Who Can Take a Loan Secured by Real Estate

People from 21 years usually approve the loan to 75 (if the borrower will be 75 or less at the time of repayment). However, not all banks have these requirements. Sometimes the age limit is 85. The primary condition is the presence of real estate.

Where it’s Better to Take a Secured Loan

Many banks accept not only apartments and land but also cars. Such credit organizations are much less, but they exist. They offer pretty favorable conditions. Almost all well-known banks give loans against the security of housing. Many today offer mild conditions for people with real estate. The current rates are below. How to get a home equity loan?

- Find a bank with suitable conditions for you (which gives a loan secured by real estate, as shown above).

- Study the requirements — if you only need an application and a passport, you can fill out an application online right at home.

- Contact the bank representatives and discuss the deal.

- Complete the paperwork and get the money.

Advantages

- They give large sums of money secured by real estate.

- Banks are happy to approve such a loan.

- Secured by real estate, you can take a home loan without a down payment.

- Banks respond quickly (within one day).

- Getting a loan can even help retirees.

- No need for an income certificate.

- Banks approve the loan basically for a long term — for 10-20 years.

Disadvantages

- Quite large over payments.

- If you don’t pay the loan on time and cooperate with the bank, you might lose the property.

- You can not give or rewrite real estate without the approval of the banking organization.

- Often, along with the loan, you have to take out insurance, which costs money.

Conclusions

Banks give a loan secured by real estate willingly, as it is a reliable option. People from 18 to 85 years old can take a loan (in some banks from 20-21 years old to 75-80 years old). More often than not, people take a home equity loan.

You may also read: 4 Advantages of Getting Quality Mortgage Broker Services