Cryptocurrencies are the newest financial fad, with Bitcoin (ticker: BTC) grabbing the headlines and Dogecoin (DOGE) nailing the punchlines. Investors now have more options than ever to convert their hard-earned cash into decentralized digital currency, thanks to the growth in the number of cryptocurrencies available on the market. According to reports, hackers have stolen traders’ money from cryptocurrency exchanges that were not adequately protected, highlighting the need to select a safe crypto trading platform before investing.

Is that being stated, which of the many crypto exchanges seems to be the most excellent fit for you?

Many variables will impact your choice, including security measures, simplicity of usage, trading costs, and the number of currencies accessible for trade, all of which play a role in determining the best crypto exchange for you. To assist you in locating the crypto trading platform that best fits your requirements, here are some of the finest choices to consider that will suit a wide range of cryptocurrency investors like bitcoin champion, a fantastic platform and top choice for bitcoin traders.

4 Best Crypto Trading Platforms

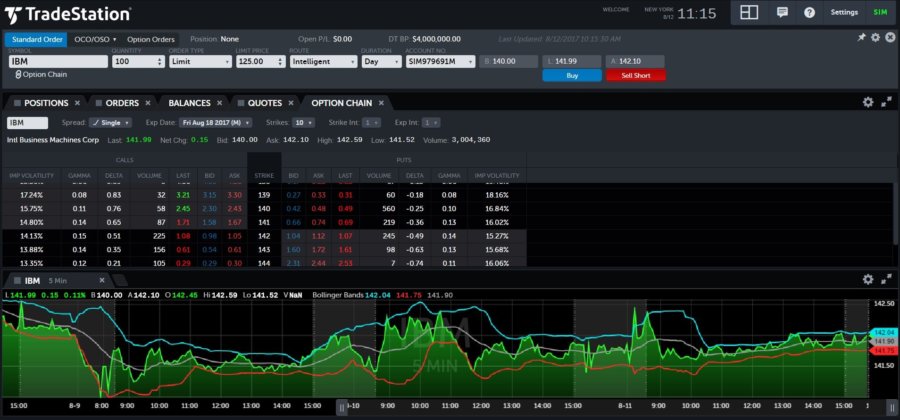

1. TradeStation

TradeStation, a trading technology pioneer, serves casual and active traders via its web-based platform and award-winning desktop interface, all with $0 stock and ETF transactions. You may use TradeStation Crypto to buy, sell, as well as trade Bitcoin, Ethereum, Litecoin, bitcoin cash, or even XRP. TradeStation is an entire company of Monex Group, Inc., one of Japan’s most prominent online financial services companies, with headquarters in Plantation, Florida. T

radeStation’s origins may be traced back to 1982 when the business was known as Omega Research. TradeStation, the business’s primary platform, was established in 1991, and TradeStation Group must have been a NASDAQ-listed company from 1997 until 2011 when Monex Group purchased it.

2. Binance.US

Binance.US, like its worldwide industry-leading cousin, provides a diverse range of cryptocurrencies, from Bitcoin and Ether to BNB, the platform’s own Stablecoins. Binance.US, like other exchanges, encourages high-volume cryptocurrency traders with increasingly reduced transaction fees, but this does not apply until your trade may be at least $50,000 in bitcoin during 30 days. (Keep in mind that even before you reach such volume, its essential trading cost may be cheaper than rivals’.) This is significant because regular traders may reduce their trading expenses by 25% by changing their investment money to BNB.

Binance.US has two complete market dashboards, Simple and Advanced, both of which include real-time market data. Binance.US, as stated in its Best Overall article, supports various order types, including limit, market, and stop-limit, which should meet the requirements of the majority of crypto traders, as well as over-the-counter (OTC) trading. These trades will be available in US dollars, USDT (a US dollar Stablecoins), and Bitcoin.

However, it is essential to remember that Binance.US does not yet offer margin trading. This hazardous technique allows traders to utilize borrowed money to boost profits while raising the amount they may lose. As a result, it is usually not advised for the novice or even intermediate investors.

You may also read: Trading Opportunities for Everyone with Bitcoin Pro

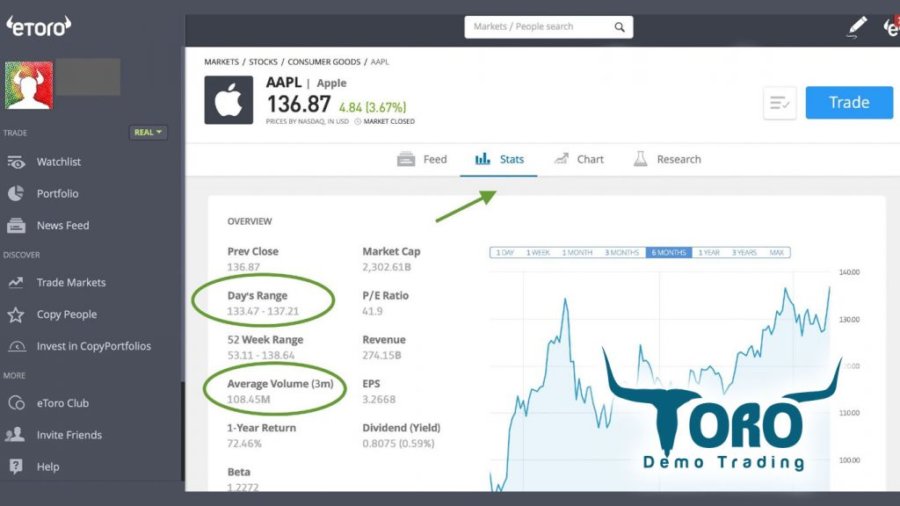

3. eToro

ETF and stock trades are free at eToro, and the user-friendly interface and access to copy trading make it an excellent choice for investors. However, eToro has hidden fees, poor training, and a smaller selection of assets than traditional brokers. It is possible to trade up to 16 currencies on eToro. Despite the cheap cost of crypto, you can only access your funds by using an eToro wallet. A pioneer in social copy trading from its inception in 2006, eToro was founded in Israel as nothing more than a developer of financial trading technology.

There are over 9 million members on this crypto trading platform, and the platform is continuously growing to become one of the world’s largest social networks, with users in over 170 countries. On eToro, transactions are free to receive and send. Both sending and receiving transactions on the blockchain have fees associated with them—a 0.1% conversion fee imposed on top of all trades made via EToro.

4. Robinhood

Payment after order flow (PFOF) is a popular strategy Robinhood uses to earn money from stock trades. Customers that trade a wide range of assets will benefit the most from Robinhood Crypto. Those who use Robinhood Crypto might sell a variety of cryptocurrencies like bitcoin and Ethereum, bitcoin cash, and a variety of Litecoins and Dogecoins.

They may receive activity-based rewards from Crypto exchanges and traders and market makers, among other crypto intermediaries, according to the Robinhood Crypto user agreement. Since Robinhood’s price structure is ambiguous, the total transaction costs may be much higher than those of the competition. Sadly, it seems that there is no way to tell for sure.

You may also like: What is NFT: How does Crypto’s New Art Non-fungible Token Work